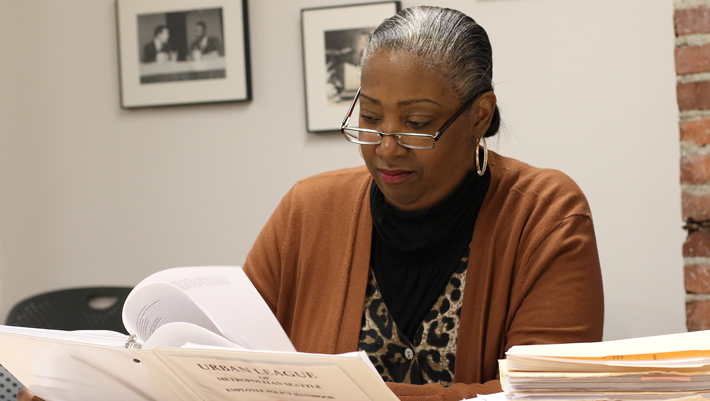

Linda Taylor

Linda Taylor “Many people are denied a loan, not because they are uncreditworthy but because they have inaccuracies on their credit report.” ~ Linda Tayor, VP of Housing & Financial Empowerment at the Urban League of Metropolitan Seattle

For the past 26 years, Linda Taylor has been working in the Seattle area helping community members realize their homeownership dream and avoid foreclosure. She says that many people are creditworthy enough to qualify for a mortgage, but they get denied because they don’t check their credit report and correct inaccuracies.

“People who don’t check their credit report sometimes end up with inaccuracies attached to their profile,” Taylor says. It’s not uncommon for someone to have late payments, defaults, and other account history on their credit report that belongs to someone else with a similar name.

“The work has been interesting but most importantly rewarding,” Linda Taylor says. “To this very day I can take a walk around Lake Washington and bump into people who say, ‘Thank you Ms. Taylor, because of your help I’m still in my house.”

Choosing Rewarding Work

Linda Taylor began her career as a receptionist at Neighborhood Housing Rehabilitation through the Seattle Housing Authority which was funded to help people fix up their homes. She went on to get her real estate license and eventually began working at the Urban League educating people about homeownership so that they can make choices based on homeownership facts not myths.

The most rewarding aspects of Linda’s Taylor work:

- Watching young people purchase homes.

- Watching young people grow to understand the importance of homeownership.

- Watching young people learn to repair and renovate their own house.

- Watching young people let go of myths and limiting beliefs.

Releasing Limiting Beliefs

Taylor noted with disappointment that the rate of Black homeownership still isn’t what it should be and that it hasn’t changed much in the past 50 years. She believes that in addition to systemic barriers such as predatory lending and credit discrimination, there are a few myths and self-limiting beliefs suppressing Black homeownership.

- Distrust of banking institutions. Because of the history of discrimination in banking some families are automatically distrustful of taking out loans.

- Low savings rates. Many Black families struggle to pay for everyday necessities and take care of their families, so savings rates are extremely low.

- Believing that you need to have 20% down to purchase a home. Many families don’t understand the financing options available to first-time homeowners, so they believe that they need a lot of cash available to buy a home.

- Fear of homeownership responsibilities. Many potential homeowners fear that home repairs and maintenance will consume their income and even put them into deeper debt. But Taylor says that many repairs and maintenance and be done DIY.

“You might be shocked at how much you’re capable of when it comes to repairing and renovating things in your home,” said Taylor. “And now that you have YouTube and the internet, it’s a lot easier to learn.”

Learn more about how the Urban League can educate you about homeownership.